Life Insurance Policy

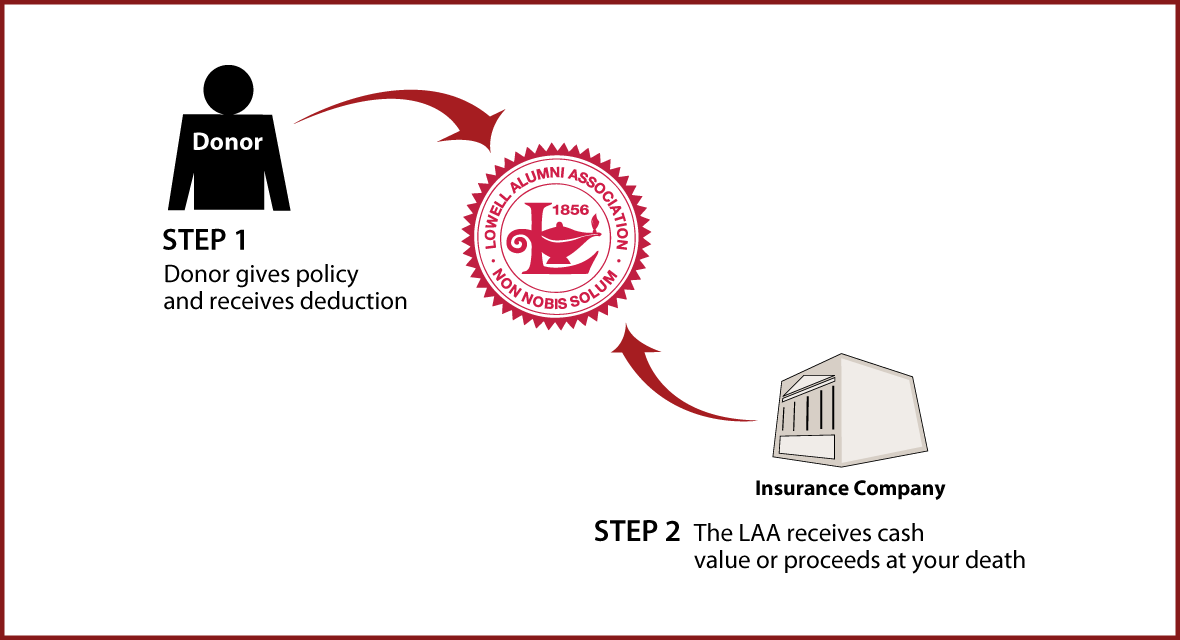

How It Works

- You assign all the rights in your insurance policy to the LAA, designate us as irrevocable beneficiary, and then receive an income-tax deduction

- The LAA may surrender the policy for its cash value or hold it and receive the proceeds at your death

Benefits

- You receive a federal income-tax deduction

- If premiums remain to be paid, you can receive income-tax deductions for contributions to the LAA to pay these premiums

- You can make a substantial gift on the installment plan

- The LAA receives a gift they can use now or hold for the future

More Information

Which Gift Is Right for You?

Back

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer