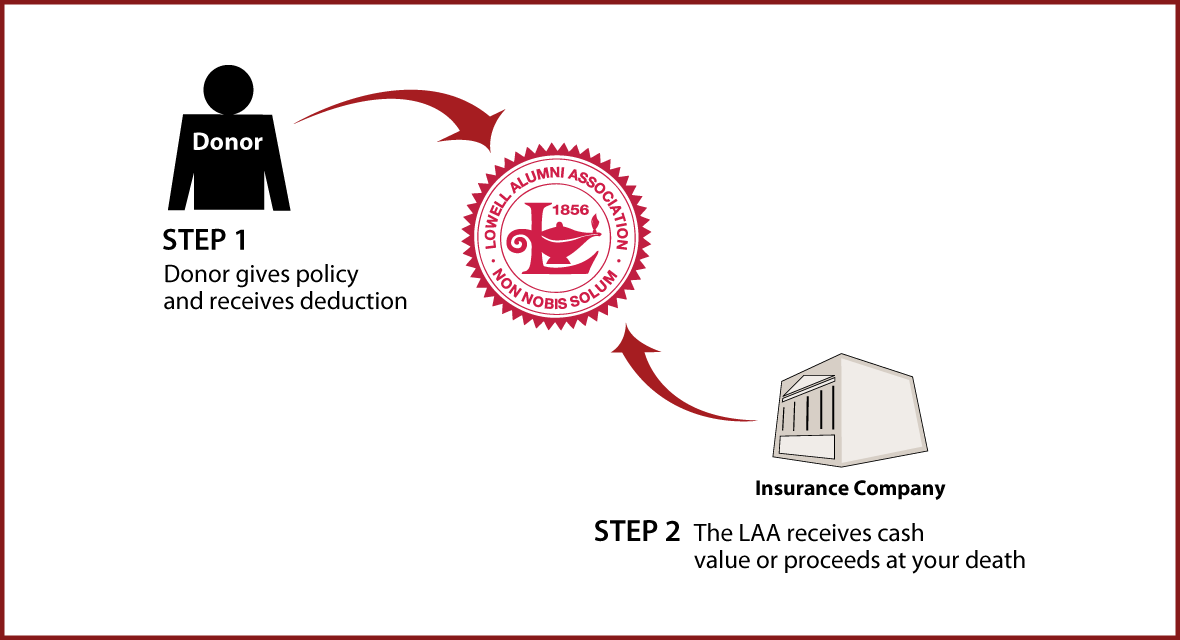

Gifts of Life InsuranceLife Insurance Policy An important but frequently overlooked role of life insurance is the one it can play in charitable gift planning. Life insurance itself can be the direct funding medium for a gift, permitting the donor to make a substantial gift (face value of policy) for a relatively modest annual outlay (i.e., the premium payment). Life Insurance Policy

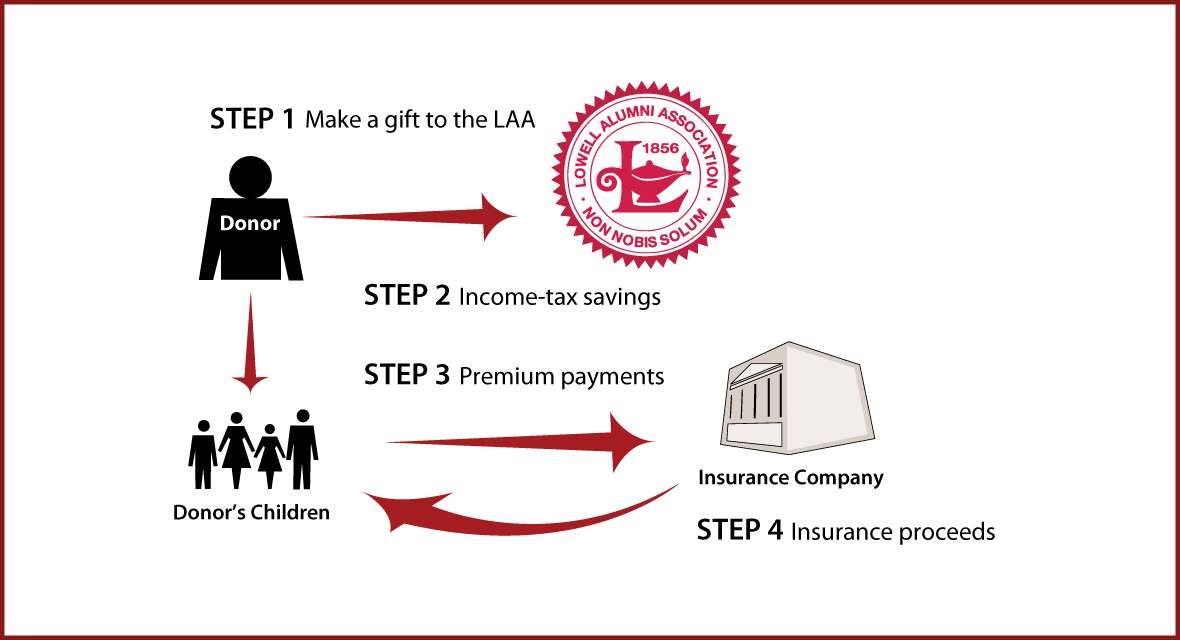

Life Insurance to Replace Gift Life insurance can also be used to replace an asset that has been given to the LAA. How it works: After a donor makes a gift to the LAA, the tax savings produced by the charitable deduction are used by his or her children or an irrevocable trust to purchase and pay the premiums on a life insurance policy on the donor's life. Such an arrangement can ensure that the interests of family beneficiaries will not be adversely affected. © Pentera, Inc. Planned giving content. All rights reserved. |

|

|